What is Margin?

- Margin is the difference between the total value of securities held in an investor’s account and the loan amount from a broker.

- Borrowing on margin is the act of borrowing money to buy securities.

- The practice includes buying an asset where the buyer pays only a percentage of the asset’s value and borrows the rest from the bank or broker.

- The broker acts as a lender and the securities in the investor’s account act as collateral.

Importance of Margin

- Margin form a key part of the risk management system.

- The uncertainty in the movement in the share prices leads to risk which is addressed by

margining system of stock markets. - Margins

ensures that buyers bring money and sellers bring shares to complete their obligations even though the prices have moved down or up.

Example of Margin

- Suppose an Investor purchases 1000 Quantities of ABC Ltd shares at a price Rs 100/- per share on 1st Jan 2019

- Then the total Purchase amount = 1 Lac

- For Margin ( Initial Token Payment ) of 15% Investor have to give 15,000/- to Broker before buying the stocks.

- For every Buyer there is a Seller. To ensure that Seller gives 100 shares similar margin is levied on him.

Imposition of Margin

Impact Cost

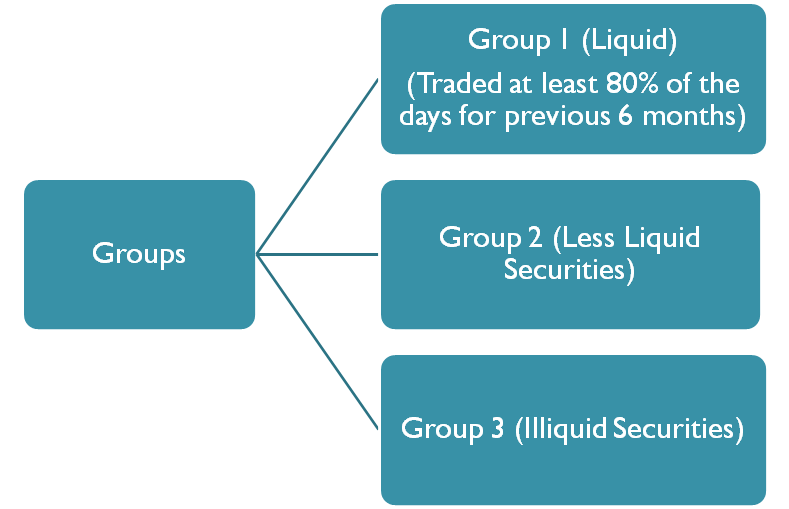

- Impact cost shall be calculated on the 15th of each month on a rolling basis considering the order book snapshots f the previous six months.

- For Group 1, Impact cost less than or equal to 1

- For Group 2, Impact cost is more than 1

- On the basis of the impact cost so calculated, the scrips shall move from one group to another group from the 1st of the next month.

- For securities that have been listed for less than 6 months, the trading frequency and the impact cost shall be computed using the entire trading history of the security.

- For the first month and till the time of monthly review a newly listed security shall be categorized in that group where the market capitalization of the newly listed security exceeds or equals the market capitalization of 80% of the securities in that particular group.

- Subsequently, after one month, whenever the next monthly review is carried out, the actual trading frequency and impact cost of the security shall be computed, to determine the liquidity categorization of the security.

- In case any corporate action results in a change in ISIN, then the securities bearing the new ISIN shall be treated as newly listed security for group categorization.

Daily Margin payable by Members

- Value at Risk Margin

- Extreme Loss Margin

- Mark-To-Market Margin

Daily margin, comprising of the sum of VaR Margin, Extreme Loss Margin

VaR Margin

- Suppose you have Rs. 10 Lac in holding and you want to know how much your portfolio can lose in a ‘single day’?

- For 5% Value at

Risk you will lose Rs12,500 per day. It means a)You are 95% confident that, maximum loses will not exceed Rs.12,500 in single day b) There is a 5% chance that portfolio losses will be minimum 12,500 or more in a single day - The VaR(5%) of Rs.12500 indicates that there will be a 5% chance that on any given day, the portfolio will experience a loss of Rs. 12500 or more.

Definition of VaR

- VaR is the Rupee or Percentage loss in Portfolio value that will be equaled or exceeded only ‘X’ percent of the time.

- VaR is a single number, which encapsulates whole information about the risk in a portfolio. It measures potential loss from an unlikely adverse event in a normal market environment.

How VaR is calculated?

- Var is computed using exponentially weighted moving averages (EWMA) methodology.

- Based on statistical analysis, 94% weight is given to volatility on ‘T-1’ day and 6% weight is given to ‘T’ day returns.

- To compute volatility of 1st Jan 2019,

first we need to compute day’s return for Jan1 st 2019 by using Ln (close price on Jan 1 2019/Close price on 31st Dec 2018) . Take - Use the following formula to calculate volatility for 1st Jan 2019

- Square root of [0.94*(Dec 31, 2018 volatility)*(Dec 31, 2018 volatility) + 0.06*(Jan 1st 2019 LN return)*(Jan 1st 2019 LN return)]

Example – Share of ABC Ltd

- Volatility on December 31, 2018 = 0.0314

- Closing price on December 31, 2018 = Rs. 360

- Closing price on January 1, 2019 = Rs. 330

- January 1, 2019 volatility = Square root of [(0.94*(0.0314)*(0.0314) + 0.06 (0.08701)* (0.08701)]

- = 0.037 or 3.7%

- VaR Margin is a margin intended to cover the largest loss that can be encountered on 99% of the days (99% Value at Risk).

- For liquid securities, the margin covers one-day losses while for illiquid securities, it covers three-day losses so as to allow the clearing corporation to liquidate the position over three days.

- This leads to a scaling factor of square root of three for illiquid securities. For liquid securities, the VaR margin are based only on the volatility of the security while for other securities, the volatility of the market index is also used in the computation.

VaR margin specified as per groups

| Liquidity Categorization | One-Day VaR | Scaling Factor for illiquidity | VaR margin |

| Group I | Security VaR | 1.00 | Security VaR |

| Group II | Higher of Security VaR and 3 times Index VaR | 1.73 (square root of 3.00) | Higher of 1.73 times Security VaR and 5.20 times Index VaR |

| Group III | Five Times Index VaR | 1.73 (square root of 3.00) | 8.66 times Index VaR |

Extreme Loss Margin

The extreme loss margin aims at covering the losses that could occur outside the coverage of VaR margins. The extreme loss margin for any security shall be higher of:

- 5% or

- 1.5 times the standard deviation of daily logarithmic returns of the security price in the last six months.

How Extreme Loss Margin is computed?

- The margin rate is fixed at the beginning of every month, by taking the price data on a rolling basis for the past six months.

- Upfront margin rates (VaR margin + Extreme loss margin) applicable for all securities in the Trade for Trade segment shall be 100%

Example

- Let us say that the VaR Margin rate for share ABC Ltd. is 13%/. Suppose that the standard deviation of daily LN returns of the security is 3.1%

- Now 1.5 times of Standard deviation would be 1.5 * 3.1 = 4.65. Here 5 % (which is higher than 4.65%) will be taken as the Extreme Loss Margin rate.

- Therefore, the total margin rate would be 18 % and the total margin payable on Rs. 10 Lac portfolio will be Rs. 1,80,000/-

How it is collected?

- In view of market volatility, SEBI may direct stock exchanges to change the margins from time to time in order to ensure market safety and safeguard the interest of investors.

- The extreme loss margin shall be collected/adjusted against the total liquid assets of the member on a

real time basis. - The extreme loss margin shall be collected on the gross open position of the member.

- The gross open position for this purpose would mean the gross of all net positions across all the clients of a member including its proprietary position.

- There would be no netting off of positions across different settlements. The extreme loss margin collected shall be released on completion of pay-in of the settlement.

Mark to Market Margin

- Mark to Market loss shall be calculated by making each transaction in security to the closing price of the security at the end of trading.

- MTM is calculated at the end of the day on all open positions by comparing transaction price with the closing price of the share for the day.

- In case the security has not been traded on a particular day, the latest available closing price at the NSE shall be considered as the closing price.

- In case the net outstanding position in any security is nil, the difference between the buy and sell values shall be considered as notional loss for the purpose of calculating the mark-to-market margin payable.

How to compute the MTM?

- MTM Profit/Loss = [(Total Buy Qty * Close Price) – Total Buy Value] – [ Total Sale Value – (Total Sale Qty * Close Price)]

- The Mark to Market Margin (MTM) Shall be collected from the member before the start of the trading of the next day.

- The MTM margin shall also be collected/adjusted from/against the cash/cash equivalent component of the liquid net worth deposited with the exchange.

Example

- A buyer purchased 1000 shared of ABC Ltd at Rs. 100/- at 11 a.m.

of January 1, 2019. - If the close price of the shares on that day happens to be Rs.75/- then the buyer faces a notional loss of Rs. 25000/- on his buy position.

- In technical terms, this loss is called MTM loss and is payable by January 2, 2019 (that is the next day of the trade) before the trading begins.

- In case price of the share prices falls further by the end of January 2,

2019 to Rs. 70/- then buy position would show a further loss of Rs. 5,000/- This MTM loss is payable by the next day.

- The MTM shall be collected on gross open position of the member. The gross open position would mean the gross of all net positions across all the clients of a member including its proprietary position.

- For this purpose, the position of a client would be netted across its various securities and the positions of all the clients of a broker would be

grossed . - There would be no netting off of the positions and set off against MTM profits across two rolling settlements. i.e. T day and T-1 day. However, for computation of MTM profit/losses for the day, netting or setoff against MTM profits would be permitted.

- In case of Trade for Trade segment, each trade shall be marked to market based on the closing price of that security.

- The MTM margin so collected shall be released on completion of pay-in of the settlement.

Penalty applicable for margin violation shall be levied on a monthly basis based on slabs.

Penalty to be levied

| Instances of Disablement | Penalty to be levied |

| 1st Instance | 0.07% per day |

| 2nd to 5th instance of disablement | 0.07% per day + Rs. 5000/- per instance from 2nd to 5th instance |

| 6th to 10th instance of disablement | 0.07% per day + Rs. 20000 (for 2nd to 5th instance) + Rs. 10,000/- per instance from 6th to 10th instance |

| 11th instance onwards | 0.07% per day + Rs 70000/- (for 2nd to 10th instance) + Rs. 10,000/- per instance from 11th instance onwards. Additionally the member will be referred to the Disciplinary Action Committee for suitable action |